Previously I’ve written a brief overview on one’s credit score in response to friends who relayed to me they weren’t exactly sure what exactly a credit score was and the role it played. After that I outlined the five major aspects that make up your credit score and how to improve each.

My post on how to get free tickets to Alaska by applying for a credit card garnered a lot of questions from friends on the topic and when I related to them that I’d actually applied for 3 different cards over a few days, (and picked up over 100,00 miles!) the tone turned from interest to incredulousness.

::Gasp:: “Won’t that destroy your credit?” is the question asked over and over again. And it’s a great to question to ask. It’s one thing to apply for one credit card and pick up a bonus. From late December to now I’ve applied for 11 different cards.

And what’s happened to my credit score? Virtually nothing. Two of my scores have gone down slightly and one of my scores actually went up.

Why is that? How can that be? Easy. Remember the different parts of the credit score pie and the role they play.

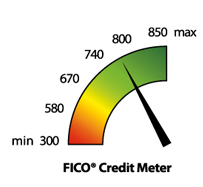

10% of your score represents, “New Credit,” so each time you apply for a loan or credit card, your score will take a hit. These are called, “hard pulls” and mean the credit bureaus are “pulling” or requesting your credit score. On average for each new credit inquiry your score will drop 2-5 points.

But “Amounts Owed” represents 30% of your score, 3x as much weight as the “New Credit” piece of the pie. And when you apply for, and get accepted for a credit card, remember your utilization goes down because your available credit goes up, thereby increasing your score for this part of the pie. Example:

Say I currently have one credit card with a $10,000 limit and I owe $5,000. My utilization? 50%. I’m currently using 50% of my available credit. But tomorrow I apply for a credit card and am approved for an additional $10,000 limit. I now have a $20,000 limit in total. I’m still owe $5,000, but because I have more available, my utilization percentage has gone down. That $5,000 represents just 25% instead of 50%. By applying for another credit card I may lose a few points off my “New Credit” piece of the pie, but my “Amounts Owed” piece of the piece is now in better shape.

A number of new credit cards are now offering free FICO credit scores each month. Barclays Bank, which offers the World Arrival Card reports to the TransUnion credit bureau. So I now have the ability to get my TransUnion score for free each month. On February 15th, a few days before the 3 card application weekend I did a yearly look at my credit report and spent $10 to get all 3 credit scores. My TransUnion score was 771. And after applying for 7 cards over a 3 month period, what had happened to my TransUnion score? Raised 19 points, to 790.

Opening multiple credit cards is not for everyone, so never, ever rush into something without fully understanding the situation or talking with someone who does. And if you’ve spent time repairing your credit or don’t feel like you can trust yourself not to spend unwisely, don’t apply for cards. But by building a solid credit score and a history of on-time payments, you’ll open the door to apply for cards if and when you want then, and rack up ton of free points and miles.

—

Leave a Comment

Comments are closed.