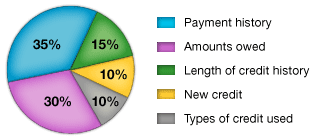

Previously I’ve listed out the five different aspects that affect your credit score and how to improve them. A good credit score is one of the most important things you can have to build a solid financial future. It will help when getting a mortgage, getting a car loan, and getting approved for rewards credit cards.

While each piece of the credit score is affected in different ways, “Length of Credit History” stands out because in a way, there’s nothing you can do, “now” that will improve it. Rather the best way to improve it is to have done something in the past The length of your credit history makes up 15% of your score and is based solely on how long you’ve had a history of using credit. Every month and year that passes that you have a credit line that’s being paid on time, you build positive credit. Simply having a credit card and paying it off for example, will build your credit score. Keep the card for a year and your, “Length of Credit History” will be longer, and therefore produce a better score. Two years, five years, 10 years… Every year will help you.

The down side as I mentioned as that unlike Payment History, (just don’t miss that payment due!) or “Amounts Owed, (pay the bill tomorrow and you’ll have less debt), your credit history isn’t something you can immediately build right now. The best option would have been to open up a card a year or two or five or 10 ago… But since that’s not an option, you have to work with that you have.

If you only have one or two credit cards, the best thing you can do is to NOT close a card, especially if it’s one that charges no fee. When I graduated college and got my first job, paying off my credit card was a big goal for me. I’d gotten one a couple years prior during one of those promotions you see at sporting events. “Sign up for this card, get a free hat!” I just wanted the hat, or whatever it was, and I’d had the card for a bit. Now that I had a job though I knew what I needed to do, “Pay the bill, cut it up and close the account! No more debt and no more credit cards!”

But that was a mistake. I was wrong. I decided that I didn’t want to be caught up in the credit game, that it was preposterous that people, “needed” credit, and I’d just buy what I wanted with cash. But the fact is, you do need credit, especially if you want to make large purchases like homes. And a good credit score is a tremendous asset. While it felt good to close the account and be done with it, I didn’t have any other credit cards to balance out my length of credit history.

So years later when I ran a credit report, instead of having my oldest credit card reporting a date of 2004, the best I could do was the one I opened in 2011. And while I had student loans that I had been paying off to help my score, I had given up seven years of, “Length of credit history,” that would help my score from now on.

My credit score is still excellent, thanks to a lifetime of on time payments and proper use, but it could have been better. By closing the one credit card I had, and one that had no annual fee to pay, I prevented myself from having seven additional years of credit card history and from possibly having even a higher score. If you’ve got one or two credit cards and you’re thinking of closing out an account, reconsider, and remember that once it’s closed you’re giving up the many months and years that you’re currently getting credit for.